FAQ

Solana is a high-throughput blockchain that is currently supporting 50–65k transactions per second and 400ms block times, without complex solutions like sharding or layer-two. As the world’s first web-scale blockchain, Solana will unlock a whole new class of performant applications and facilitate larger scale blockchain adoption. Utilizing a revolutionary innovation called Proof of History, Solana is drastically able to outperform any other existing layer 1 and provide fees at $0.00001 per transaction.

To know more about Solana’s ecosystem

👉 Website (https://solana.com/)

👉 Twitter (https://twitter.com/solana)

👉 Community Channel (https://t.me/solana)

👉 Solana Forum (https://forums.solana.com/)

SOL is Solana’s native cryptocurrency, which works as a utility token. Users need SOL to pay transaction fees when making transfers or interacting with smart contracts. The network burns SOL as part of its deflationary model. Like Ethereum, Solana allows developers to build smart contracts and create projects based on the blockchain.

SOL uses the SPL protocol. SPL is the token standard of the Solana blockchain, similar to ERC20 on Ethereum. The SOL token has two main use cases:

- Paying for transaction fees incurred when using the network or smart contracts.

- Staking tokens as part of the Proof of Stake consensus mechanism.

Staking is the word used to refer to a process of gaining rewards for holding certain crypto currencies. In other words, a staker contributes to the Proof of Stake (PoS) network of a certain crypto asset. Whilst staking a crypto currency, a staker makes the blockchain of that crypto currency more efficient and safer. In return, he/she receives a reward in the form of network tokens within the same network. To produce rewards on a PoS blockchain, a node needs to assign a specific number of network’s tokens as a stake. The odds of that node being selected to authenticate the subsequent block are directly correlated to the number of tokens that are being offered as a stake. In an event in which the node successfully authenticates a block, it’s getting a reward. Naturally, authenticators lose a part of their stake if they happen to authenticate a fraudulent business transaction. This type of punishment encourages them to only authenticate the non-fraudulent business transactions.

Solana staking is where an owner of Solana coins (SOL) can “delegate” them to a validator in order to earn rewards, in much the same way you can “delegate” your home fiat currency to a bank in order to earn interest.

As Solana is a Proof Of Stake (PoS) cryptocurrency, it relies on users delegating stake to its validation network in order to keep the network healthy: the stake each validator holds helps prove they are trusted to vote on transactions and confirm they are legitimate. As it is such a vital function to the network, in exchange rewards are given based on the size of the stake to each participant. The rewards themselves are based on Solana’s inflation rate, which falls over time as the number of transactions on the network increases.

Currently those rewards equate to a roughly 7-8% APY annual income on staked coins, of which each validator may take a small fee (typically 0-10%). This means that by simply staking your coins instead of holding them in a wallet you could earn anywhere from 7.2% – 8% each year, which is far in advance of cash interest rates at most banks.

MEV stands for “Maximum Extractable Value” and pertains to the additional profits a block producer can earn by manipulating transaction inclusion and order. This includes capturing arbitrage opportunities and optimizing trade order for extra gains.

Jito is an advanced MEV infrastructure for Solana validators and is designed to maximize profits from MEV opportunities while reducing network spam. Its features include off-chain blockspace auctions and efficient reward distribution.

At its core, Proof of Stake (PoS) is a crypto consensus mechanism that is utilized for the production of new blocks. It necessitates randomly chosen validators to stake the network’s token in order to authenticate blocks and gain rewards. These authenticators lose a part of their stake if the transaction turns out to be fraudulent in its nature.

The word “validator” is used to refer to nodes responsible for authenticating transactions. Validators are backed by their stake (a certain amount of the network’s token). Selecting reliable validators increases the cost of a possible attack on the network. Validators receive cryptocurrency rewards in return for them backing the transactions with their stake.

Persons that hold tokens and want to stake them but don’t want to operate a validation node are called delegators.

If you stake tokens, you provide assistance in safeguarding the network and receive monetary rewards in the process. It’s possible to stake by delegating your assets to validators that sort out the dealings and operate the network. Naturally, delegating your assets is a shared risk and reward business deal which might yield significant benefits to token holders over a long period. The best financial outcome is attainable when the economic goals of delegators and validators are aligned.

Solana’s goal is to offer a decentralized currency that is scalable, cost efficient and extremely fast. To do so, it has based its coin on a Proof Of Stake system where validators help ensure the integrity of the system, approving transactions in a fraction of the time of other coins such as ETH or BTC.

In order to do so it needs to incentivize the validators to help assist in auditing transactions. Each validator provides a service of verifying transactions and aims to seek consensus with other nodes on the network to ensure the security of transactions. Since each validator also needs to hold a stake as a sign it can be trusted, these rewards are shared with people who choose to stake their SOL in the validation network.

By spreading stakes across the thousand+ validators in the network rather than concentrating it in the hands of a small minority it keeps the network robust and secure, preventing attacks from bad actors that might attempt to defraud holders of SOL.

In short: not only do you earn monetary rewards by staking your coins on Solana, but you actively help Solana reach its goals and ensure the integrity of the network. For many this is reason enough to stake coins or run validators, beyond any personal gain.

Staking SOL(s) will generate rewards for you based on the size of your investment – currently around 8% per year. This means if you stake 100 SOL today, by this time next year you should be owning 108 SOL.

But it doesn’t stop there. We are in a transformative period with cryptocurrency, and Solana is rapidly gaining credibility due to its incredibly fast transactions with very low fees. As a proof of stake network it comes without the baggage of traditional proof of work currencies such as Bitcoin and (for now) Ethereum, and is thriving with the current trend of NFTs as collectors see the huge difference in transaction feed between buying with SOL vs ETH’s outrageous gas fees.

All this is to say there is a strong chance that Solana becomes more popular over time. Past performance is never an indicator of future results, but Solana has increased in price 520% since same period of last year.

There is no guarantee that it will continue to rise at such a rate, but such increases are not unheard of in the crypto market.

If you are bullish on crypto, and bullish on SOL’s proposition, then you could imagine a much greater increase in value over a year than 8%, when compared to a fiat currency such as USD.

Yes, staking Solana is extremely safe: at no point do the validators you stake with have any control over the SOLs you stake, and you remain in control of your SOLs throughout the process.

Our service entails non-custodial delegations which means we don’t control your funds. No need to worry: you will always be in complete control of your digital funds and you are able to pull your delegation out at any given point in time. When you let us delegate, your funds are added to our stake virtually. The block chain network will move the rewards to your address in an automated fashion.

At any time you can request a withdrawal back to your main wallet – although you will need to wait until the end of the epoch before your coins will arrive, which can take anything from a 5 mins to 2.5 days (depending on the exact timing of the action you perform).

The one risk that does exist is that the commission a validator charges on your rewards is subject to change depending on the whims of the owner.

This means that you may have signed up to a validator at a fee you thought was fair – say 5% – but the validator could increase this without warning. This might be a minor rise to something like 10%, which would only slightly dent your income, or if they truly went rogue they might increase it to 100% and keep all the rewards for themselves.

However this would not affect the coins you have staked, just the rewards. Since your SOLs are simply “delegated” to the validator and not under the validator’s control, should this happen your stake would still be 100% safe – you’d just stop earning rewards. You could simply leave and move your stake to another more reputable validator.

This helps keep the market in check – validators rely on having a significant stake delegated to them in order to stay profitable, and any abusive practices would quickly lose their stake. It would be a classic case of killing the golden goose – a short term profit in exchange for a long term business failure.

Finally of course we should point out that the price of any cryptocurrency, including Solana, can go down as well as up. But if you’re here we expect you already understand that.

Note: On a website such as validators.app or solanabeach.io or stakewiz.com you do see validators with commissions set to 100%. Generally this is not a sign of foul play! It’s not uncommon for large financial institutions to run their own private validators, setting the commission to a maximum of 100% to avoid 3rd parties delegating stake to the network. This is mostly done for regulatory reasons – they may have to account for the rewards paid to stakers which for a large financial institution could be a significant legal and administrative burden, so it is simpler to discourage others from staking with them and avoid the issue entirely.

Some proof of stake cryptocurrencies use a system called “slashing” to keep validator nodes in check, ensure they are operated fairly and punish bad behavior. Depending on the cryptocurrency this may result in the staker losing a portion of their delegated funds, while others will just punish the validator.

At present Solana has no slashing mechanism as part of their terms so your funds are totally safe from being slashed.

No, it’s not possible to lose any of your Solana tokens by staking on the network. Solana has been very careful to produce a staking platform where you maintain complete custody of your funds. The validators you delegate to have no way of accessing your stake account or transferring it elsewhere. There is currently no slashing on the network either, meaning you will never withdraw less Solana from your staking account than you put in.

With over 1,500 validators it can be hard to choose a validator. The best places to stake are with validators who care about the state of the network and the health of their nodes. This means they should:

- Run on high performance hardware for a higher APY

- Keep their nodes running 24/7 and minimize downtime

- Operate from a datacenter with a low-concentration of stake, to avoid centralization issues

- Hold a lower than average share of network stake, to help decentralization and avoid network halts

We’re proud of our validator and strive to meet all the criteria above – if you’d like to stake with us, please do!

I’m a solo founder (backed up by couple brothers-in-arms) who’s been in crypto since early 2015. My original background was data science (statistics and financial econometrics), which lead me into crypto world and to start contributing to emerging projects, starting from 2015.

One of my businesses was establishing crypto mining farms, which gave me the server skills and devops experience that allowed me to start a validator on the Solana blockchain. With 8 years of experience in bare metal server management – and 15 years of geeking servers and command lines before that – I know how to secure and run a stable system with maximum uptime.

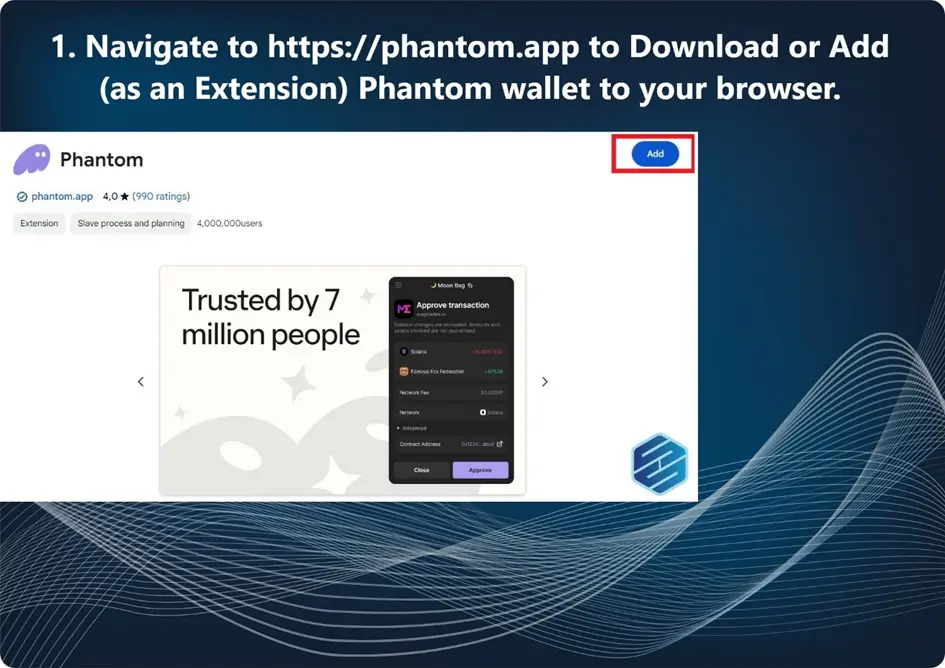

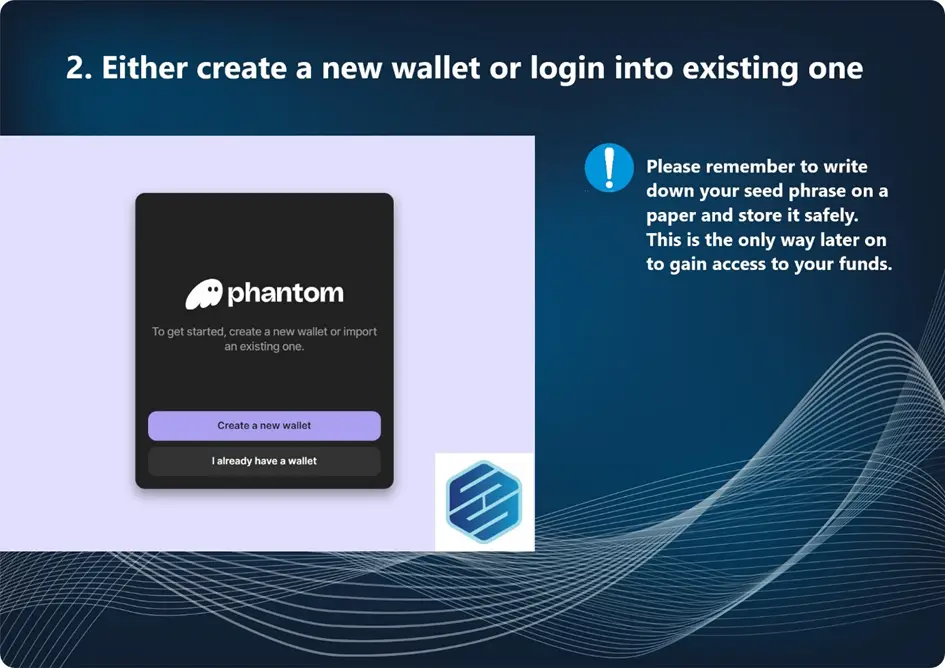

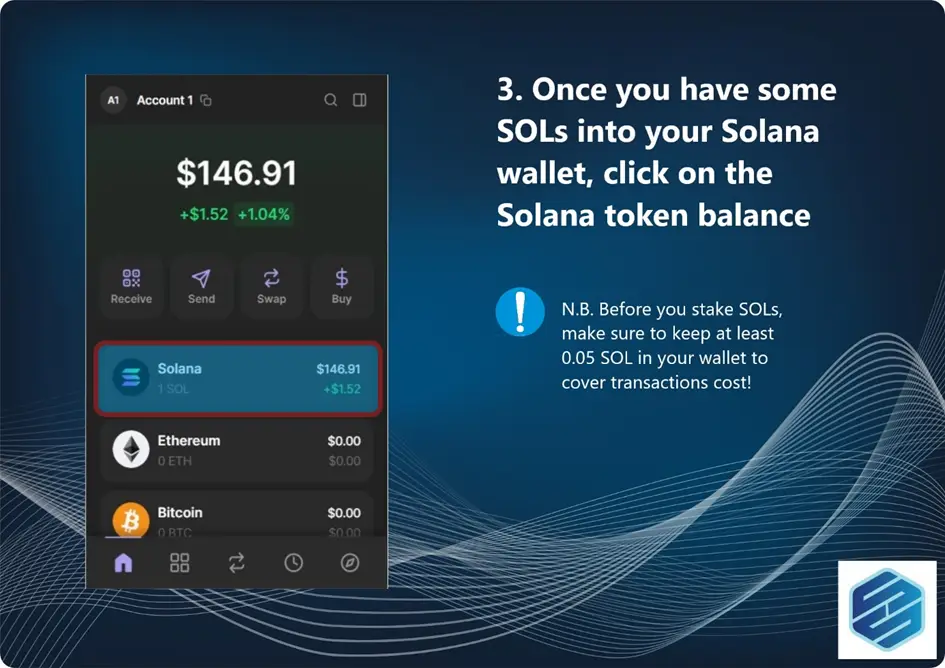

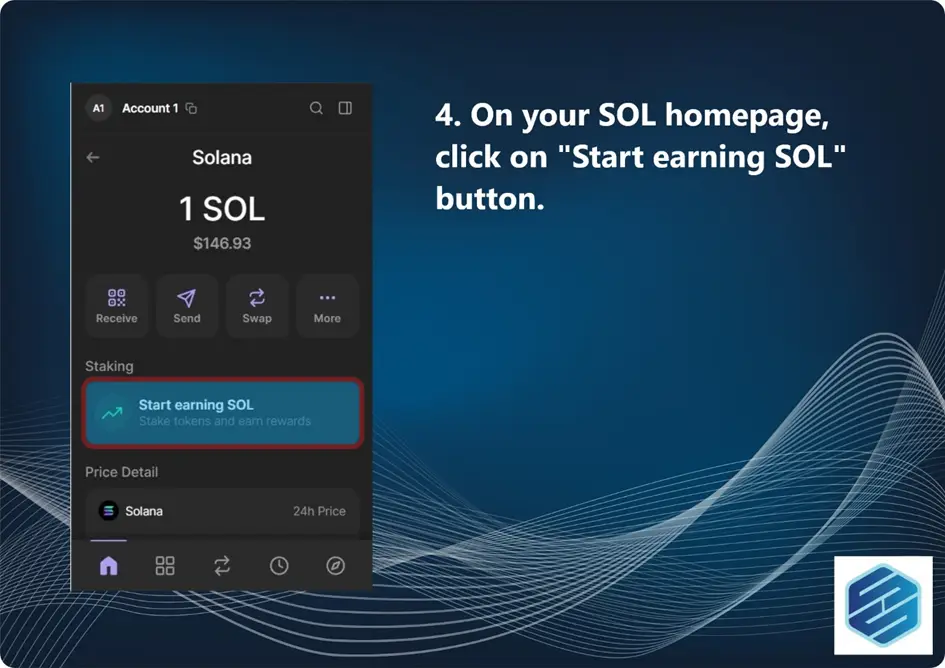

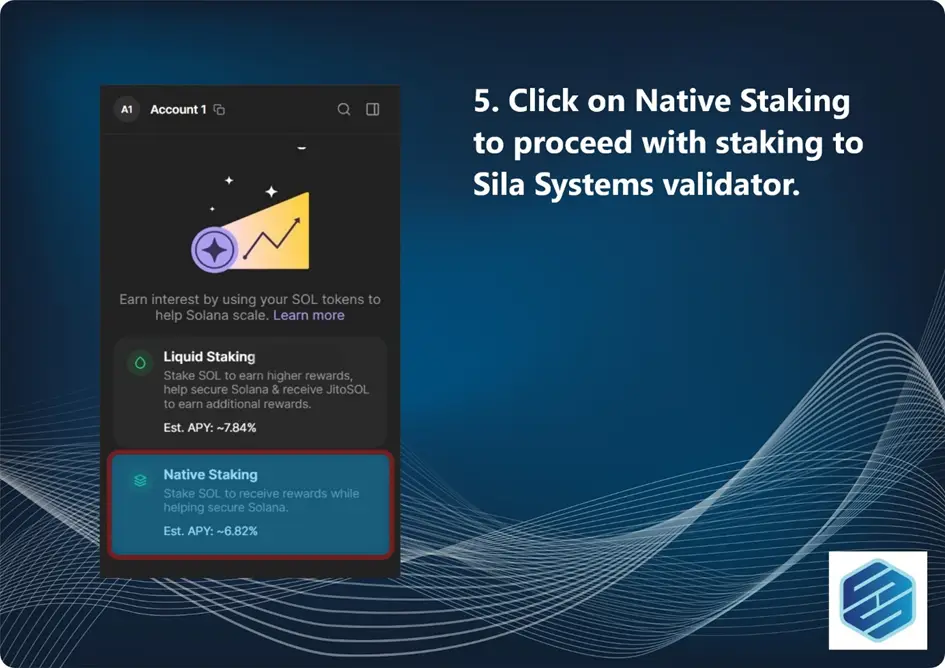

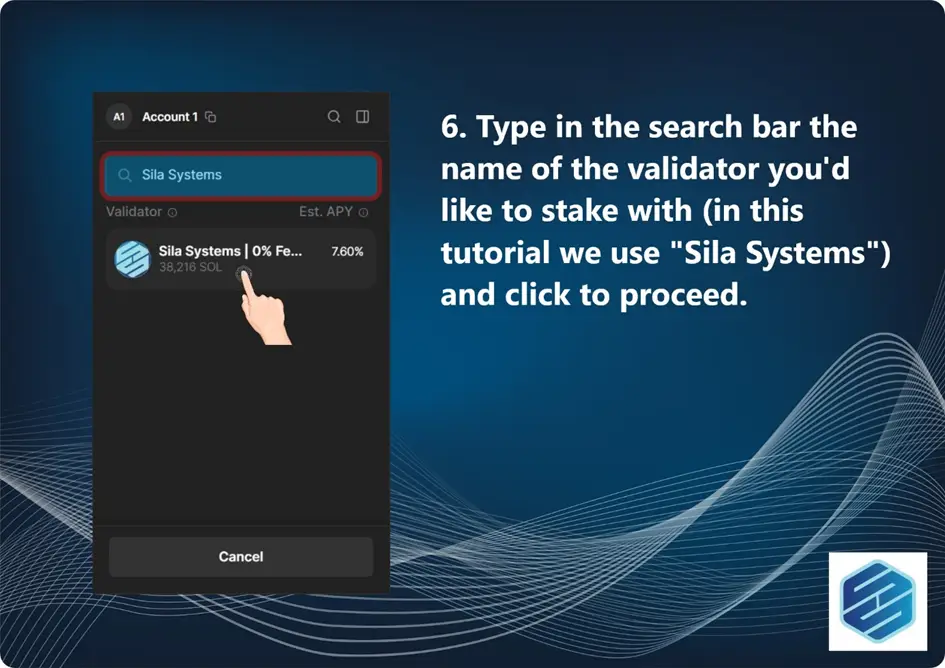

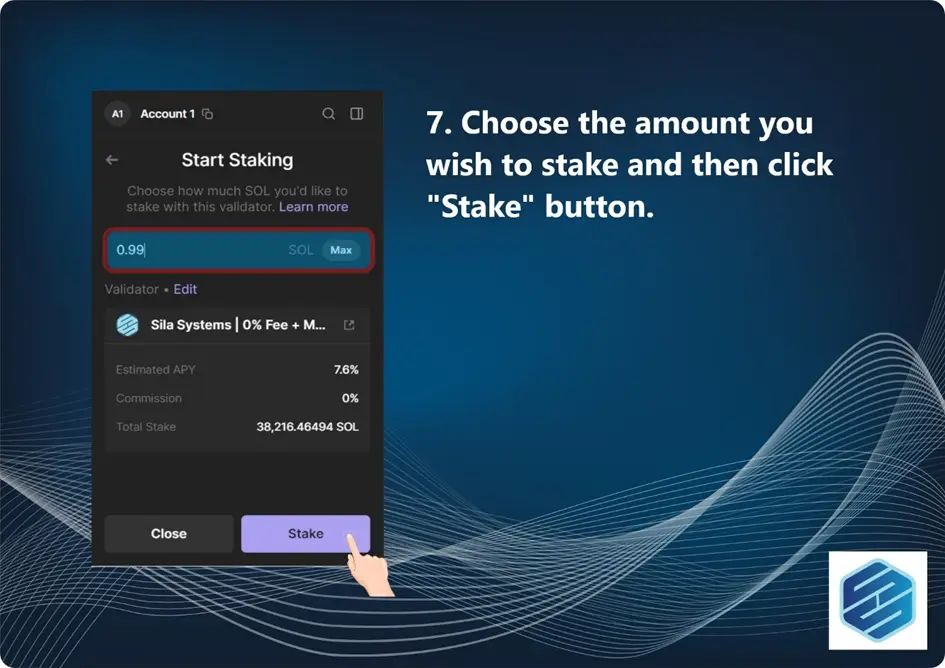

Start staking with Sila Systems is simple. To stake SOL tokens, you must use a wallet that supports staking.

Not all wallets support staking at this time. The most reliable and trustworthy that are recommended are:

› Phantom Wallet (https://phantom.app/)

› Solflare Wallet (https://solflare.com/)

At Sila Systems, we employ advanced security measures to protect your staked SOL tokens. Our platform ensures that your staking experience is not only profitable but also secure. However, as with all investments, there is always some level of risk, and it’s essential to stay informed and cautious.

Our primary node sits at datacenter in Sofia (BG) with a backup in London (GB).

We use the latest generation AMD Threadripper 7960X CPU Servers with 512GB of RAM and 10Gbs Network connections.

Server Security: Sila Systems cares deeply about security. Our mainnet servers are hosted in enterprise grade data centers with tight physical access controls, power backups, 24/7 monitoring, and alerting. OS access is restricted to SSH keys only, password based log ins are fully disabled.

Key Security: Validators must operate with three important accounts/keypairs. The Validator Identity keypair which signs all transactions, the Voting account which stake accounts are delegated to, and finally the authorized withdrawal keypair which enables SOL to be moved to and from the validator. The first two keys are required many times a second and must remain on the Validator server. These Keys are backed up in a secure enclave and encrypted with 256-bit AES encryption. The third keypair, Authorized Withdrawal Keypair, is stored in a hardware wallet such that the private key has never been connected and will never be connected to the internet.

There is no minimum amount you can stake on Solana. Each Solana coin (SOL) can be spent in tiny increments known as Lamports. Much like there are 100 cents in 1 Dollar, there are 10 billion (10,000,000,00) lamports in 1 SOL. Or put another way, 1 lamport has a value of 0.000000001 SOL.

Theoretically you could stake just a handful of lamports, although not only would you be waiting forever for rewards of any useful size, but you would also likely spend more on transaction fees than you would ever stand to make.

As with any sort of investment with a percentage return, the more you stake the greater your return. With the power of compound interest you can see considerable returns over time, but much like saving for retirement it really pays to stake more, earlier.

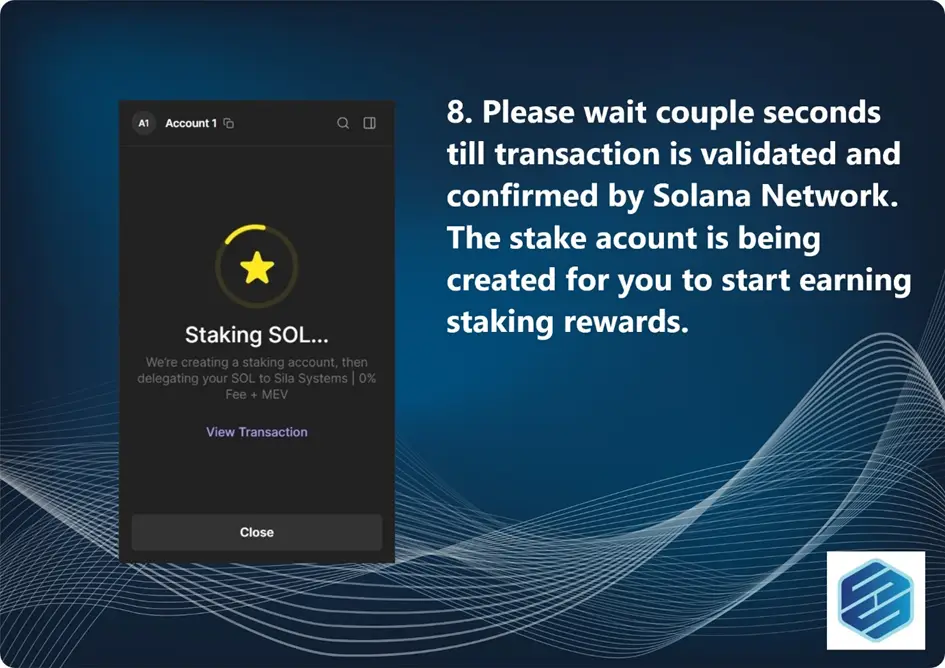

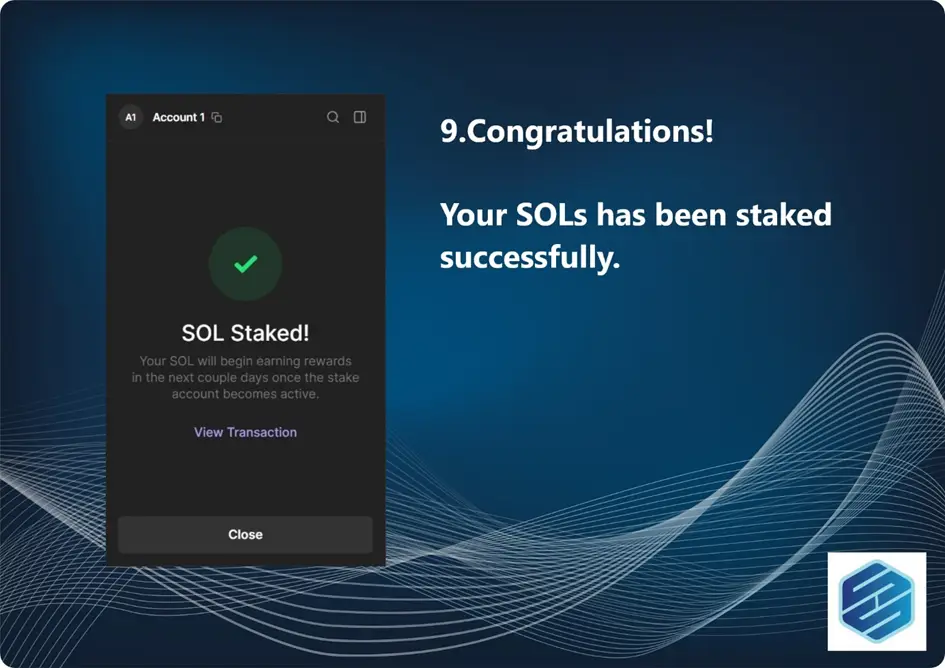

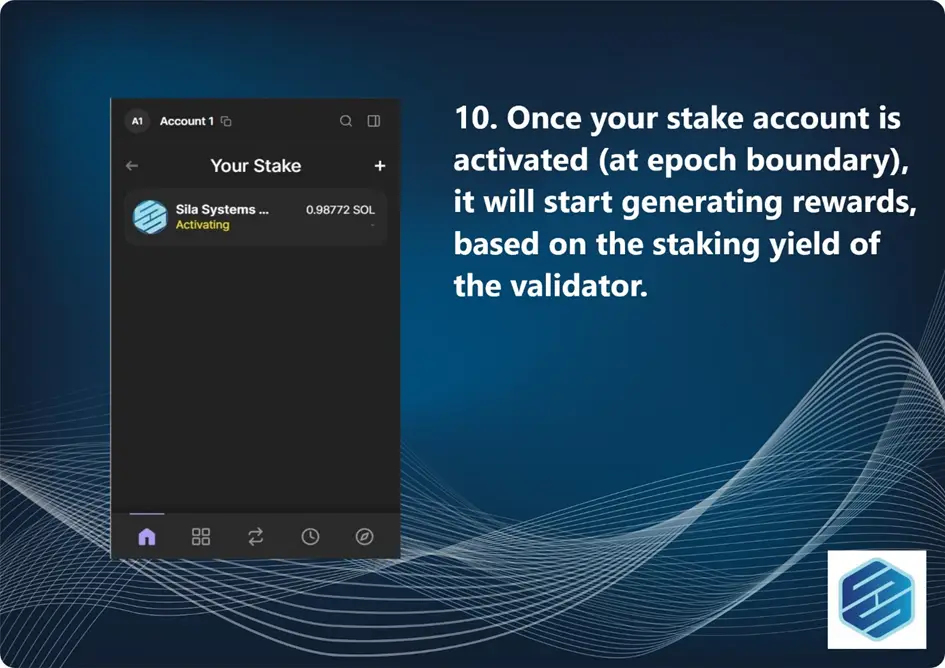

Newly delegated tokens are considered “activating” or “warming up”, and are not eligible to earn rewards until they are fully activated. Hence, you need to wait till the next epoch to start earning rewards.

Newly un-delegated tokens are considered “deactivating” or “cooling down” and are not able to be withdrawn until deactivated at the epoch boundary. Once the stake is deactivated, withdraw tokens to start using them again.

The unstaking process can vary depending on the network’s rules. For Solana, there’s an unbonding period during which your tokens are held before being released. During this period, your tokens are not earning rewards and are not accessible for transactions. Always check the current network rules or reach out to our contact page for the most accurate information.

Depending on when you unstake your Solana, it can take anything from 5 minutes to ~48 hours. Rewards are given to stakers at the end of each epoch, and this is when new stake accounts are activated and old ones deactivated. Each epoch lasts around 2 1/3 days, so if you unstake near the end of the epoch you may be able to withdraw your funds within a few hours. However, if the epoch has just started it might take a couple of days until your stake account has fully deactivated and your funds are available to withdraw.

Staking rewards are calculated based on the amount of SOL you stake and the length of time you keep it staked. The rewards come in the form of new SOL tokens, generated by the Solana network as a way to incentivize participation.

APY stands for Annual Percentage Yield. It is a standard measure of the total returns you can expect to earn from staking in a year, accounting for the compound interest that can be earned on staking rewards.

The APY for Solana can fluctuate depending on the number of transactions per day and the speed at which validators complete an epoch, but at present it is between 7-8%.

The actual amount of reward you receive each epoch can also vary based on the commission rate set by the validator you stake with. These are displayed transparently by the network, and typically range between 0 and 5%. It is worth noting that the operators of validators can change this rate.

Your real world returns can also depend on the performance of a validator – how fast are they processing and voting on transactions? This can be dependent on uptime, internet connectivity speeds and the power of the servers the validator is using.

Helpfully there is a site that shows the true, live APR you can earn from each validator, https://stakewiz.com . The site automatically computes:

- The performance of the individual validator in the last epoch, including

- Uptime / Reliability

- Speed (indicated by a lower ‘skip rate’)

- Minus the commission they charge

- Averaged over the year

This then provides a figure for the ‘true’ APY of a validator, which currently ranges from 8 % to as low as 1%. Crucially some of the validators with low APY actually have fairly low commissions – between 0-5% – so their poor performance is due to technical issues rather than commission rate alone.

- The performance of the individual validator in the last epoch, including

You can buy SOL on a number of popular exchanges, including the world’s top exchange in terms of trading volume Binance. Also note, there is no minimum requirement to stake SOL for delegators.

Yes – by connecting your Ledger to the Phantom wallet you can securely stake your Solana. Your private keys remain safe on your hardware wallet, and each time you wish to delegate or undelegate your stake you simply confirm the transaction using the Ledger.

More technically minded users can also use Solana’s command line tools to stake with a hardware or paper wallet, ensuring your private keys are never held on a digital device. Check Solana’s own documentation for getting started with a paper wallet.

At present the best wallets for staking on Solana are Phantom and Solflare. Both now offer a mobile app that makes it even easier to manage your Solana accounts on the move – all you need is a good signal!

There are couple of other wallets that provide staking, but they do have some drawbacks. For example, Exodus wallet allows you to stake, but only offers their own validator as an option. As a result of Exodus’ popularity, their validator has an abnormally high share of stake, threatening decentralization and the security of the network.

We don’t recommend staking with Binance, Kraken or Coinbase. Not only do you lose custody of your funds and arguably put their security at risk, but these huge centralized exchanges pose a threat to the health of Solana’s network. With so much power in the hands of a centralized entity, it is important to understand the risks of staking with these exchanges.

**1. Lack of decentralization ** Solana’s consensus system is designed to be decentralized and the network is designed to be resilient to attacks that could halt the network. The more stake that is concentrated in a small number of validators, the more fragile the system becomes.

These huge exchanges often run their own validators, amassing a huge share of the network stake and decreasing the Nakamoto coefficient. This means that the network will be less secure and more vulnerable to attacks.

**2. Lack of reliability and security ** Furthermore, large exchanges tend to run their nodes as a small part of their business, and often operate nodes for hundreds of blockchains at once. This means they are not as focused as independents on running a top validator – it’s just not a priority for them. For example, they often use outdated hardware that struggles to keep up with the rest of Solana’s network, which at times of high activity have contributed to slowdowns. These slowdowns can have an impact on the yield investors receive on their stakes.

They can also be slower than others to update their software – and as Solana is still in beta it is essential validators are responsive to new software releases, helping resolve bugs faster and improve quality of service for the entire network. This lack of response can delay improvements being made to the network.

**3. Geographic centralization ** Typically the systems run by large exchanges are hosted in huge, centralized datacenters such as Amazon’s AWS. This means that the validators are not geographically distributed and are vulnerable to attacks. It also means in the case of an outage at one of those datacenters – of which Amazon had a few in 2021 – the entire network could be affected, as without sufficient stake online other nodes will struggle to form a consensus.